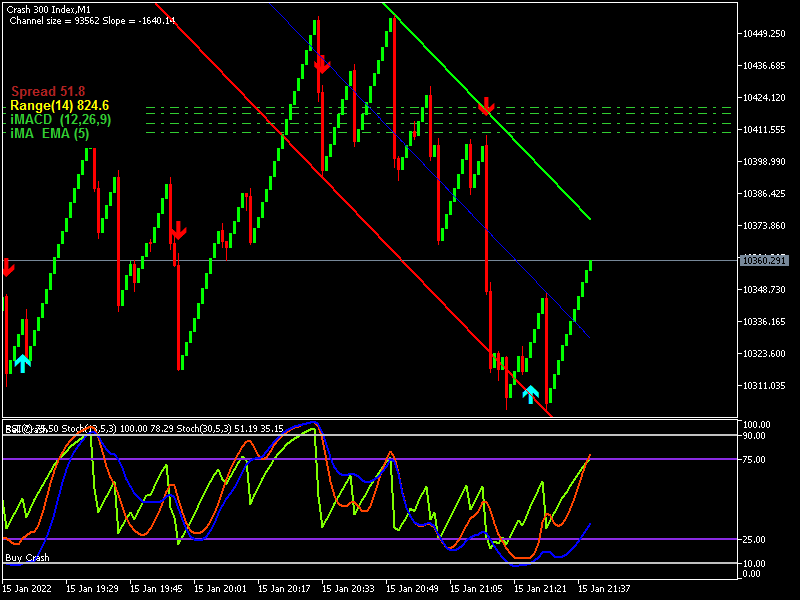

BEST STRATEGY FOR CRASH 300 Triple your account using this Strategy

The Boom index as the name suggests refers to a sudden large spike in the market that could be as huge as 50-60 pips in the spike While the Crash Index refers to a sudden breakdown in the market prices that could be as huge as 50-60 pips. These spikes or breakdowns could occur within the one-minute timeframe chart.

Binary Trading Boom And Crash How To Trade Boom And Crash Indices

How to Trade Crash 300 Index with a Robot Forex Villa Pro 2.92K subscribers Subscribe Subscribed 50 2.4K views 1 year ago Men Of Wealth V3+ Ultimate, A forex trading robot is backtested on a.

Crash — TradingView

Crash 300 index Crash 500 Index Crash 1000 Index The Boom & Crash 300 indices have, on average, 1 spike in the price series every 300 ticks. The Boom 500 index has, on average, 1 spike in the price series every 500 ticks while the Boom 1000 index has on average 1 spike in the price series every 1000 ticks.

NEW Tips & Tricks on how to trade Crash 300 index YouTube

Crash 300 Pip Calculator is a calculator that calculates the value of a pip for synthetic indices called Crash 300 index Home Education Forex Trading for Beginners Forex Currency Pairs Forex Trading Platform Forex Trading Basics Forex Order Types Forex Trading Analysis Forex Broker Setups Forex Calculator Pricing Members Members Start page

BOOM 300 INDEX AND CRASH 300 INDEX IS HERE HOW TO FIND THEM AND ADD

S Stock Split P Candlestick Patterns To hide/show event marks, right click anywhere on the chart, and select "Hide Marks On Bars". See how it's done » Live indices chart that tracks the movements.

Create an EA trading Pad, Indicator and Spike detector to trade Boom

Synthetics Baskets Derived FX Deriv's proprietary synthetics simulate real-world market movements. Backed by a cryptographically secure random number generator, these indices are available to trade 24/7 and are unaffected by regular market hours, global events, or market and liquidity risks. Synthetics trades available on Deriv CFDs Options

Best Crash 300 Index Strategy YouTube

$19.99 What you'll learn You will learn the best approach to use when trading Crash 300 index The nature of the Crash 300 index and how it moves How to perfectly trade Crash 300 index ticks How to accurately trade spikes and make Profits in seconds The perfect time to trade and exit your trades Requirements

boom and crash 1000 index strategy binaryforexvolatility in 2021

CRASH 300 Analysis For Intraday Setups Join Our Telegram ChannelTelegram Channel: https://t.me/superflycapitalFacebook: https://www.facebook.com/superflycapi.

How to Trade Boom 300 and Crash 300 Successfully Motivation Africa

CSI 300 Index Price, Real-time Quote & News - Google Finance Markets $73.53 +$0.83 Home 000300 • Index CSI 300 Index Follow Share 3,347.05 Jan 4, 4:30:00 PM GMT+8 · SHA · Disclaimer search.

Crash — Indicateurs et Signaux — TradingView

Crash 300 Index CRASH_300_X This composite index's behavior simulates stock market crashes. The average time between crashes is only 300 ticks, which is reflected in the instrument's name. Forecast Time: 10m 1H 12h 1D Expected rise of +0.67% Buy now in order to sell with a profit at 11:40 12/14/2023 The forecast updates in soon

How to trade crash 300 index profitably and successfully YouTube

Don't Enter a sell position on Boom 1000, Boom 500, and Boom 300. Trade only to catch the the upward spike in Boom indices. Don't enter a buy position Crash 1000, Crash 500, or Crash 300. Trade only to catch the downward spike in Crash indices. Always set a stop loss to avoid losing too much money when the market goes against you.

ESTRATEGIA CRASH 300 INDICES SINTETICOS YouTube

1.17K subscribers Subscribe 1.5K views 6 months ago Boom and crash are a part of synthetic indices exclusive to DERIV . They have an idiosyncratic and specific behavior. when you understand how.

BOOM 500/1000 AND CRASH 500/1000 Signals Helper Guide

Crash 300 Index. Ticker Symbol: CRASH_300_X. This composite index's behavior simulates stock market crashes. The average time between crashes is only 300 ticks, which is reflected in the instrument's name. Forecast Time: 10m 1H 12h 1D. Expected rise of +0.35%.

Crash 300 index. YouTube

Boom 300 Index. Crash 1000 Index. Crash 500 Index. Crash 300 Index. Step Index. Bear Market Index. Bull Market Index. Volatility 10 (1s) Index. Volatility 10 Index. Volatility 25 (1s) Index. Volatility 25 Index. Volatility 50 (1s) Index. Volatility 50 Index. Volatility 75 (1s) Index. Volatility 75 Index.

SELL CRASH 300 index BOOM 300 Index Sniper trading Stratégie YouTube

A Synthetic Index attempts to simulate the behaviour of an entire type of market, just like the way a Stock Index (like The Dow Jones or S&P 500) has a more generalised focus than an individual Stock. What moves synthetic indices?

Latest crash 300 index strategy YouTube

The crash index (1000 - 500) is the average price decline that occurs every 1000 - 500 ticks. In the Crash 1000 index, a price drop occurs, on average, every 1000 ticks. In the Crash 500 index, a price drop occurs roughly every 500 ticks. Unlike the Boom index, the Crash 500 is more volatile than the Crash 1000 index. How to trade Boom and Crash?